Whilst there is no crystal ball to predict the future of fintech, specialists can make informed projections based on what the latest trends are saying. For example, one of the most check here noticeable trends in fintech companies is the prioritisation of sustainable and green fintech. Simply put, even more fintech companies are striving to promote ESG campaigns and sustainability aims into their business procedures. One of the manner ins which they have done this is by incorporating carbon-footprint tracking into banking applications and payment systems. Through AI and various other technologies, it will be much easier for fintech businesses to evaluate ESG data and make much more accurate measurements of the general environmental impact, as presented by firms in the Germany fintech market.

In 2025, there have already been a number of amazing developments in fintech. According to research, among the most popular advancements in fintech is the emergence of open banking. Open financing and open banking symbolize a huge leap forward in the financial market, mostly due to the fact that they enable customer-permissioned access to transactional data throughout numerous accounts. In other copyright, open banking innovations helps with the seamless assimilation of bank accounts with brand-new financial products. In addition, the open banking technology has transformed into a platform for more advancements in the fintech world, such as fraudulence prevention and payment initiation. In addition, another typical trend within the fintech industry is the application of Blockchain and the Internet of Things. To put it simply, Blockchain ensures secure and transparent transactions without intermediators, while the Internet of Things is a network of interconnected devices which accumulates and shares data. Both of these groundbreaking modern technologies complement and facilitate one another in a selection of ways, with smart contracts and digital assets being a few good examples. Looking forward into the future, experts expect that these innovations will only become far more embedded into the financial services sector, as suggested by firms operating in the Malta fintech field.

Fintech is an industry expanding at a quick rate; nevertheless, the fintech growth statistics don't lie. The global fintech trends speak for themselves; fintech is being incorporated into progressively more companies within the banking, financing and investment sectors. As an example, one of the primary ways that fintech has dominated these sectors is through artificial intelligence and machine learning. These kinds of innovations have actually already caused waves within the finance market, mostly by streamlining and automating what was originally extremely time-consuming or difficult processes. Generative AI and chatbots have actually made it possible for organizations to offer 24/7 customer care, which increases overall productivity. Large language models have actually also had the ability to improve risk examination, supply predictive analytics, assist in regularity compliance and conduct investment research. All of these AI applications have efficiently reduced expenses and time, therefore improving the firm's total efficiency and performance. Not just this, by AI has likewise been found to be an asset when it involves enhancing scam detection, as shown by firms in the UK fintech sector.

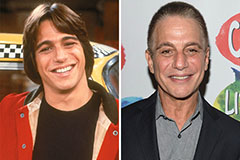

Tony Danza Then & Now!

Tony Danza Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!